You’re sitting and thinking about all the tasks you have to do before moving day. You haven’t even broken the news to your friends. You still need to search Utah moving companies. You’re making your first big move and want it to be a good experience. You want your belongings to be protected.

Did you know you can purchase moving insurance to protect your household items and give you peace of mind in case of accidents? Usually, moving companies offer free, basic coverage to insure your things, but you can always purchase more comprehensive coverage if you have many high-value items or an extra-long trek to your new home.

For many, basic coverage is enough and meets federal interstate requirements. If you feel you need full-value coverage, it will likely cost about 1% of the value of your items. And coverage at all is void if you pack your own belongings.

Moving Insurance: What Exactly is it?

If you’ve never moved with a moving company, you may be unsure about what moving insurance is. Moving insurance is a protection plan for your belongings that your moving company transports for you. There are usually three standard moving insurance options:

- Basic: Basic coverage is the most limited form of moving insurance. It’s often known as “released value protection.” It does cover your items but not at the full value of the item.

- Full: Full coverage protection covers the total replacement value of lost or damaged goods. This is often called “expanded valuation” or “full-value protection” insurance.

- Third-party Insurance: In some cases, you may want even more coverage than a moving company’s standard complete coverage protection. For super high-value items, some people opt for third-party insurance.

According to federal law, interstate moving companies must offer primary and full-coverage coverage options. Technically speaking, moving companies can’t sell “insurance.” It’s actually “moving coverage,” but most people consider it insurance. Actual moving INSURANCE is sold through those third-party companies only.

Which Coverage Option is Best For You?

The coverage of your belongings depends on which plan you pick. The best plan for you may come down to the value of your items and your trust in your moving company.

Basic Coverage

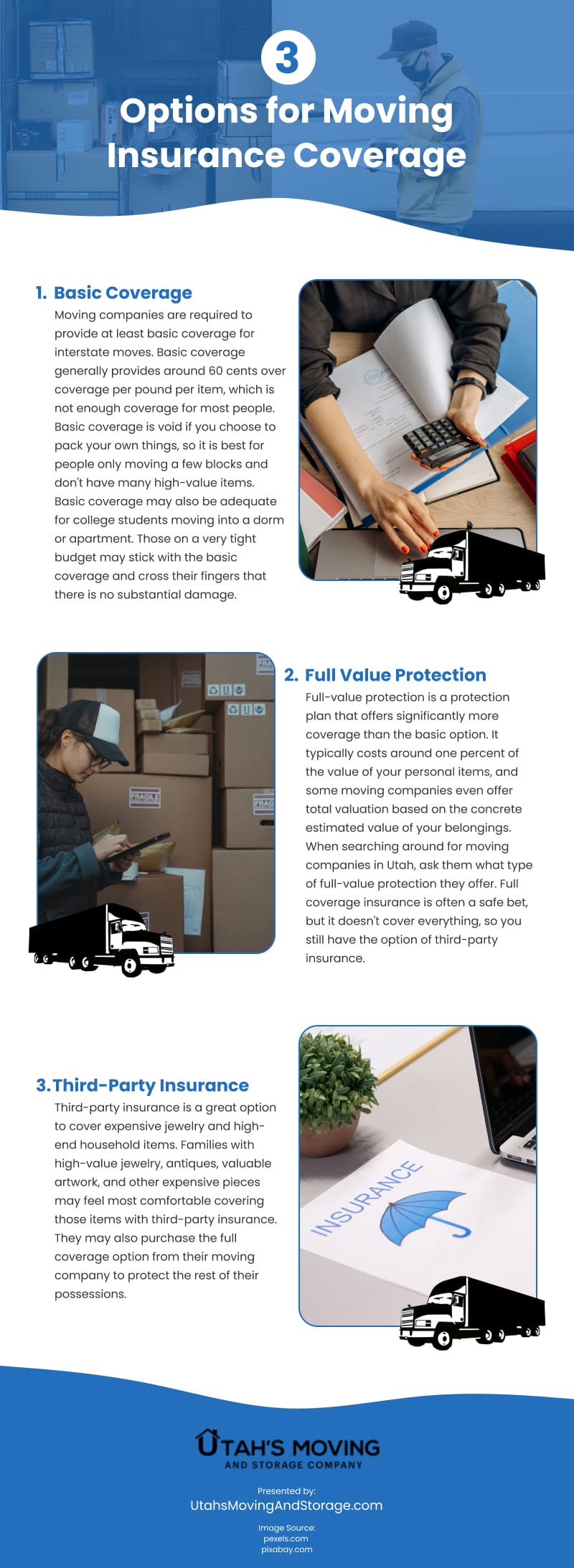

Moving companies are federally required to provide at least basic coverage for interstate moves. When receiving a quote from a moving company, they include the cost of basic coverage, so you shouldn’t have to pay extra. If they claim you have to pay extra for basic coverage, that’s a red flag.

Basic coverage generally provides around 60 cents over coverage per pound per item. That often isn’t enough coverage for most people. For reference, an average 50-inch TV is about 35 pounds. That would mean that basic coverage would only reimburse $21 for damage to a 50-inch TV.

Basic coverage is also void if you choose to pack your own things. If you pack it, you assume responsibility for it. Basic insurance may be best for people only moving a few blocks (less chance of damage or theft) and don’t have many high-value items.

Maybe your stuff isn’t worth much, and you wouldn’t be devastated if your couch from the 70s was damaged. Basic coverage might also be adequate for a college student moving into a dorm or apartment. Those on a very tight budget may stick with the basic coverage and cross their fingers that there is no substantial damage.

Full Value Protection

When purchasing full-value protection, you secure a protection plan that offers significantly more coverage than the basic option. An average coverage estimate for full-value protection is six dollars per pound. Say your total shipment was 5,000 pounds, and the whole thing was damaged, destroyed, or lost. You’d be entitled to up to $30,000. This type of coverage typically costs around one percent of the value of your personal items.

Some moving companies even offer total valuation based on the concrete estimated value of your belongings. When searching around for moving companies in Utah, ask them what type of full-value protection they offer.

Full coverage insurance might be the best option for families traveling cross-country to their new home. They may be willing to spend a bit more to ensure protection on the long trek full of unexpected weather or natural disasters. If you’re driving through tornado alley during tornado season, it’s better to be safe than sorry.

Full coverage is often a safe bet. However, it doesn’t cover everything, so you still have the option of third-party insurance.

Third-Party Insurance

For many with a lot of very high-value items, it’s worth the cost to get third-party insurance. Third-party insurance is a great option to cover expensive jewelry and high-end household items. It might be the best option if you want to be sure you have coverage against the following:

- Damage from natural disasters

- Electrical/mechanical accidents

- Mold and mildew

- Moths and other insects

- Temporary storage

Families moving across the state with high-value jewelry, antiques, valuable artwork, and other expensive pieces may feel most comfortable covering those items with third-party insurance. A family like this would also purchase the full coverage option from their moving company to protect the rest of their possessions.

What Does Moving Insurance Cover?

Technically, moving coverage and moving insurance are two different things. Moving companies can offer moving coverage; only third-party insurance companies can offer actual moving insurance.

Covered by moving company: Damage or lost items while under the care of the moving company, up to a particular dollar amount.

Third-party insurance coverage: Damage or lost items due to situations out of the control of the moving company’s control or for amounts exceeding the liability limit.

Knowledge is power, and we want you to feel empowered as you embark on your move. Remember that you’re entitled to basic coverage. Still, you can always pay for better coverage or third party-insurance for peace of mind that you’ll be well compensated if something unfortunate happens to your high-end items. We love to educate the community on the ins and outs of the moving process. Stay tuned for another blog about what moving insurance doesn’t cover.

Infographic

Did you know that moving insurance is available to safeguard your possessions and provide ease of mind in mishaps? Typically, moving firms offer free, basic coverage to insure your belongings. Still, you may acquire more extensive coverage if you have many expensive items. Take a look at this infographic to learn the three options for moving insurance coverage.

Video